Changelog

Follow up on the latest improvements and updates.

RSS

improved

Improved Rebalance

Rebalance has a new home in the right-side menu!

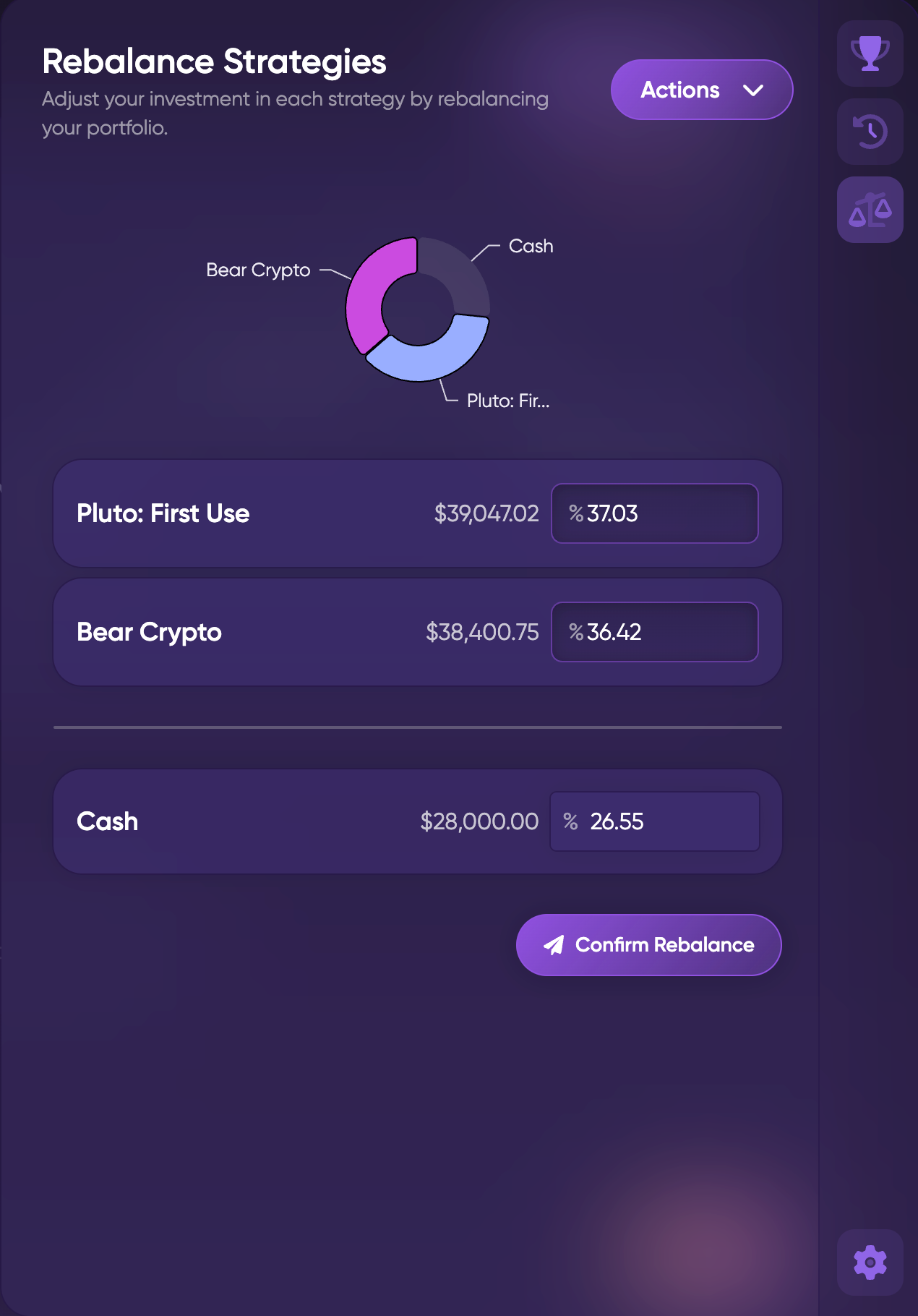

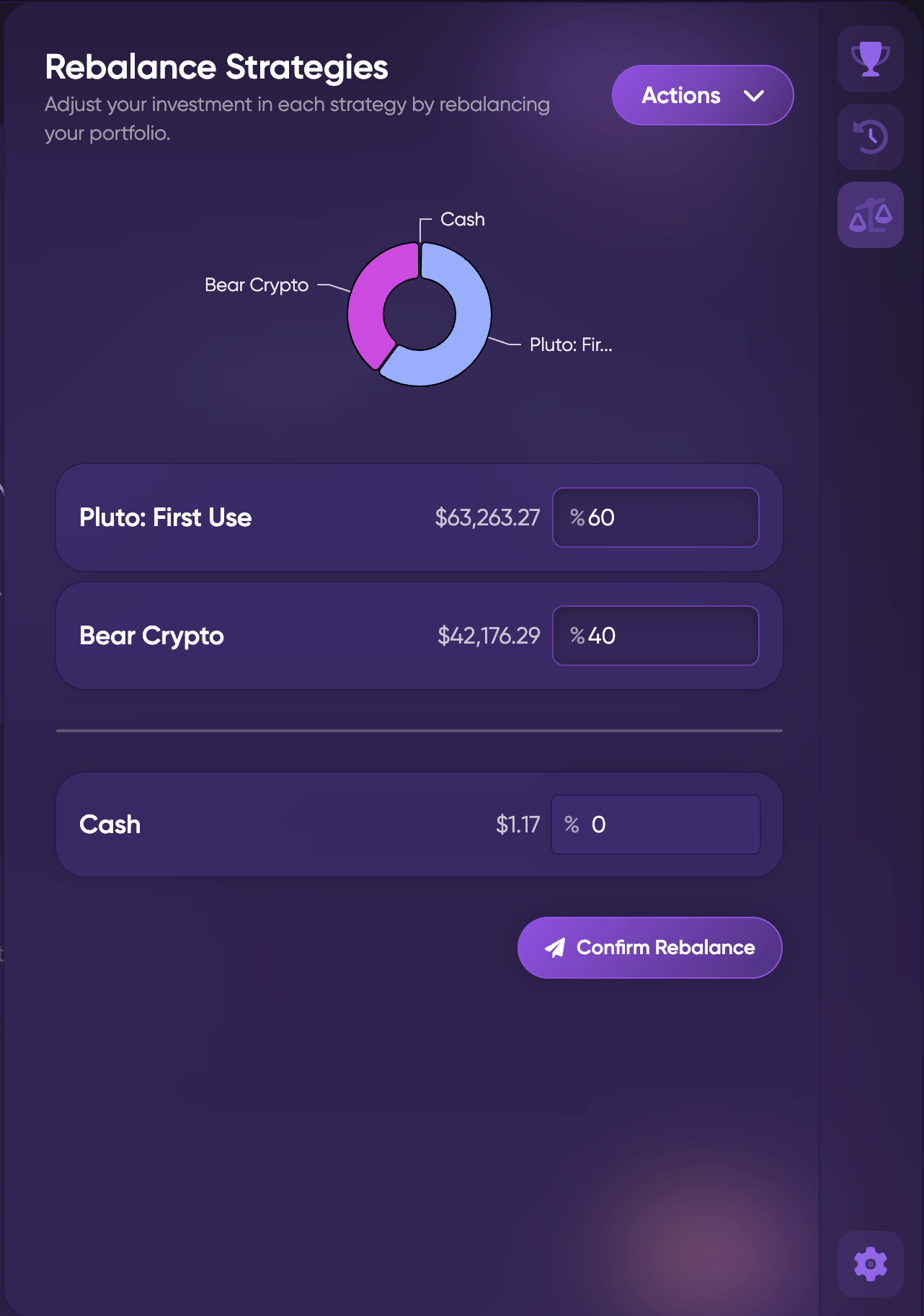

The focus of Rebalance 2.0 is to allow for setting and resetting asset allocation. Much like an investor would hope to stick to a 60% stock and 40% bond portfolio, we want to make sure Pluto investors can set and reset their strategies to specific allocations. This idea led to the first major change in that the rebalance view will show you each strategy in your portfolio, as well as its approximate percentage weight in the portfolio.

When rebalancing, you can either deposit into a strategy by pulling from the pool of remaining cash, or you can withdraw from a strategy which will direct the funds into the pool of remaining cash. You can do both of these in conjunction to effectively move money from one strategy to another.

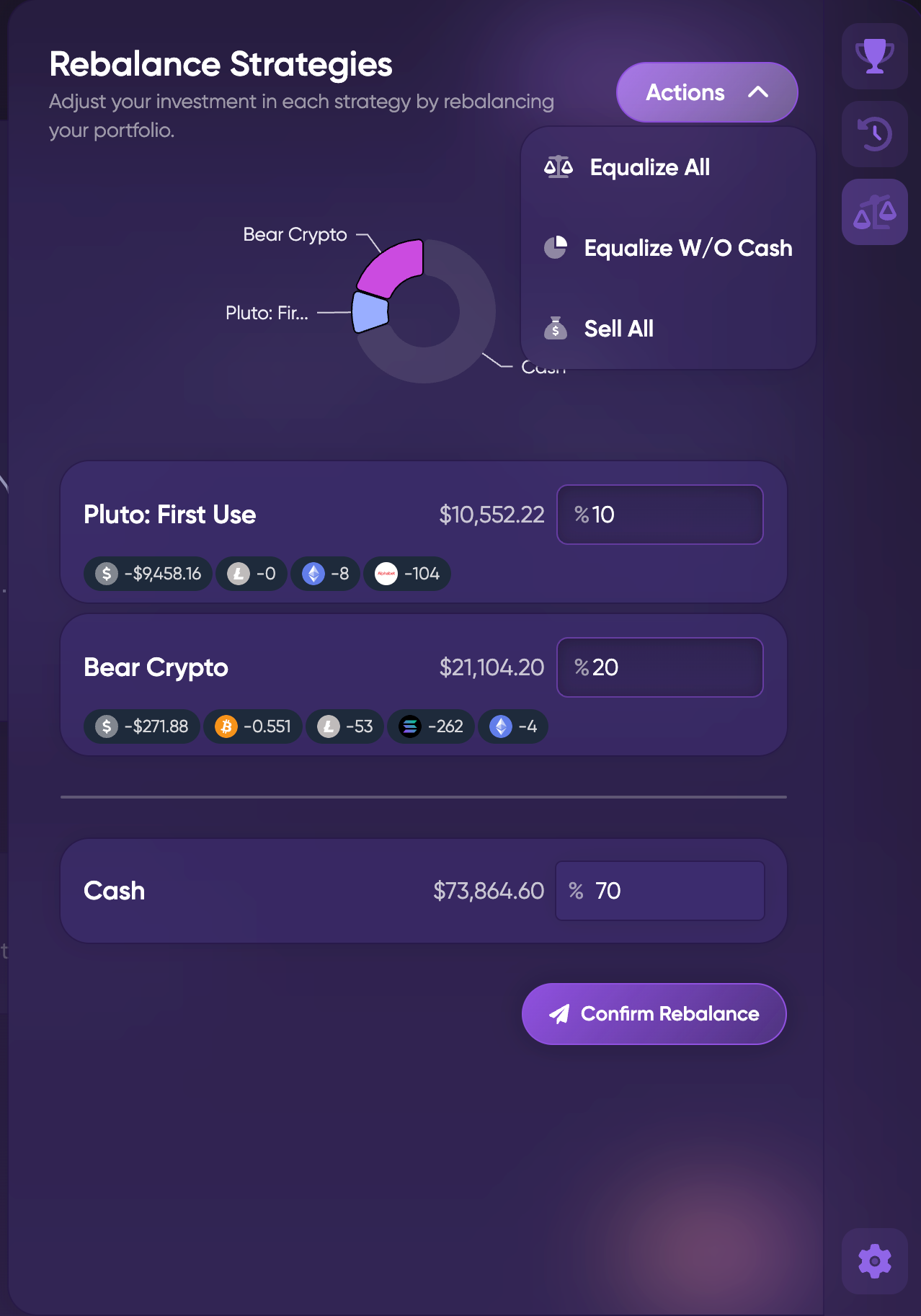

There are 3 actions we thought might be useful to users to do quickly.

- Equalize All: Equalize all will take the total amount of money in each strategy and in the remaining cash and distribute it as evenly as possible between all active strategies.

- Equalize W/O Cash: Equalize w/o cash will take all of the money within each strategy, ignoring the remaining cash, and distribute it as evenly as possible between each active strategy.

- Sell All: Sell all simply sells everything in each strategy and moves all the money into the portfolio's remaining cash.

Each of these items can also be used as a jumping off point, in which you can select one of the actions, such as Sell All, and then move the money among whichever strategies you choose.

Finally, there are some small limitations with the Rebalance:

- The percentages are an approximation, which can lead to numbers that seem a little off. For instance, the cash in one of the images above says it is 0%, but there is still $1.17 remaining. This is due to the percentages of the items above being rounded, and to ensure that you are not able to deposit more total money than you actually have.

- Rebalances are always an approximation. If you choose to withdraw money from a strategy, there is no way to guarantee the exact amount from selling securities inside of that strategy. As a result, the estimated trades as well as estimated resulting balance are just that: estimations. However, we try to get as close as possible.

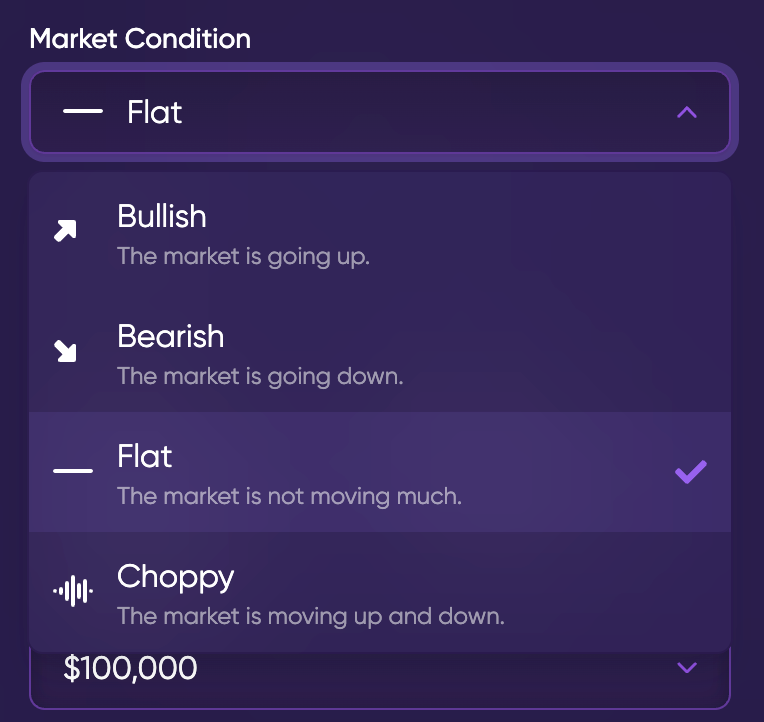

The team is busy making progress on live trading for crypto, but we're slowly moving our focus back to exciting product features. Here's a quick update to custom scenarios.

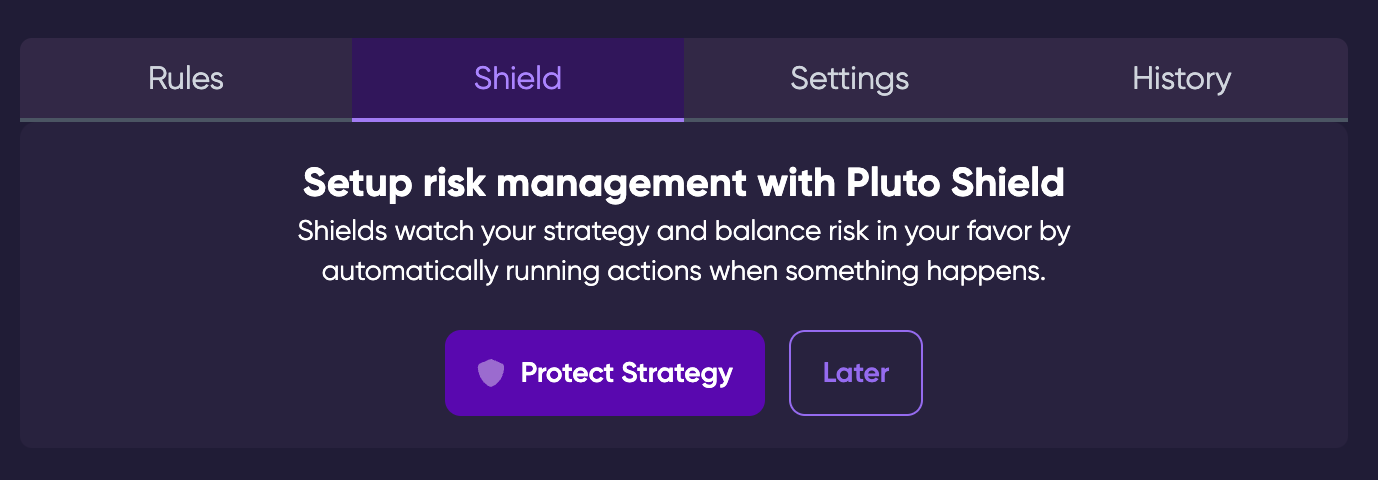

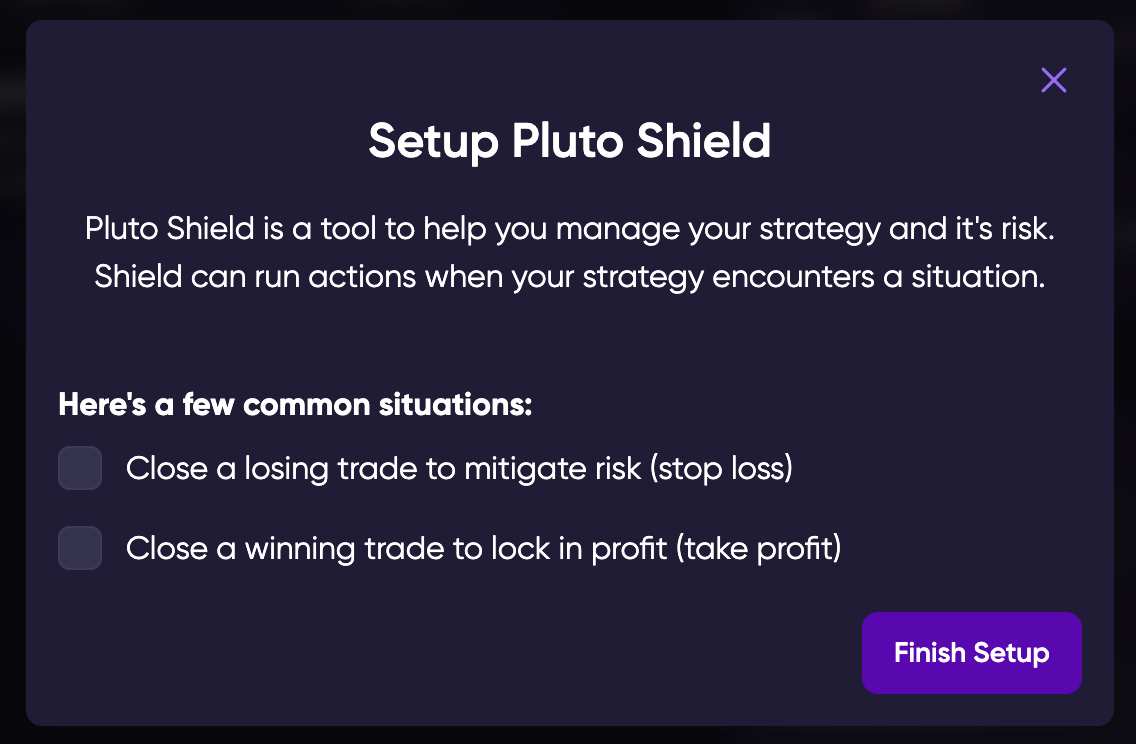

It works very simply. In any given strategy, there will be a tab entitled "Shield." By pressing it, you're presented with this prompt. It'll let you know the basic functionality, and once you know, you can get into activating your own customized shields. These act as kill switches for your strategy that override any and all code or blocks you've written. By giving a simple prompt for its activation, you create a floor or ceiling to the amount of risk you are willing to absorb in any given strategy.

Read more on our blog:

Setup is easy

Example

Say you create a strategy that can respond well to the movements of tech companies in the S&P, and you want to capitalize on those as best as possible. But on sudden, unforeseeable down days, you might lose 10% or more of your portfolio based on those same rules that let you buy before the rise. That's bad news, and nobody wants to eat that cost if they can help it. Shields make a big choice for your strategy, overriding what your automation might not catch and protecting your gains.

Shield Templates

Quick Setup guide

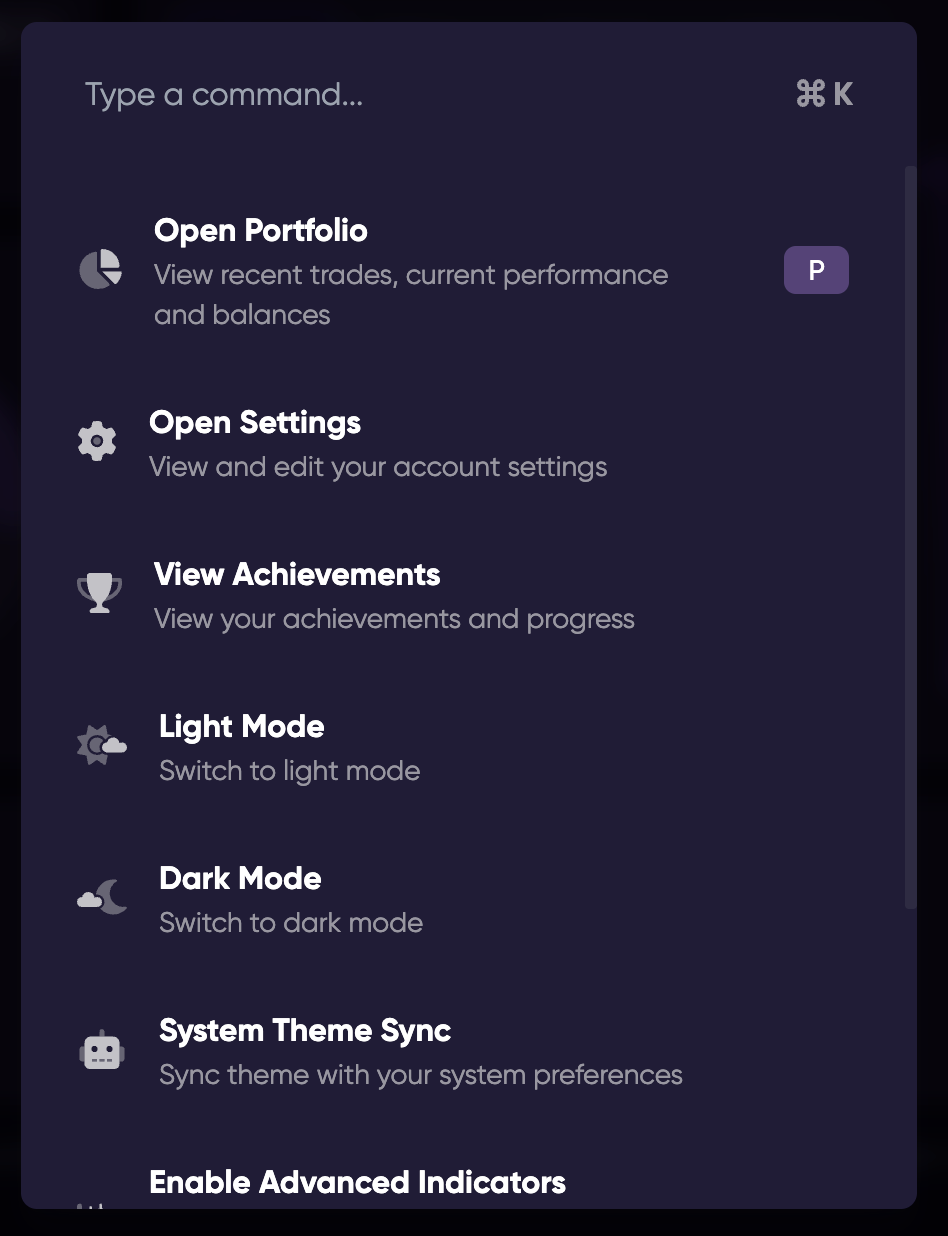

Do the things you need easier from the new command palette

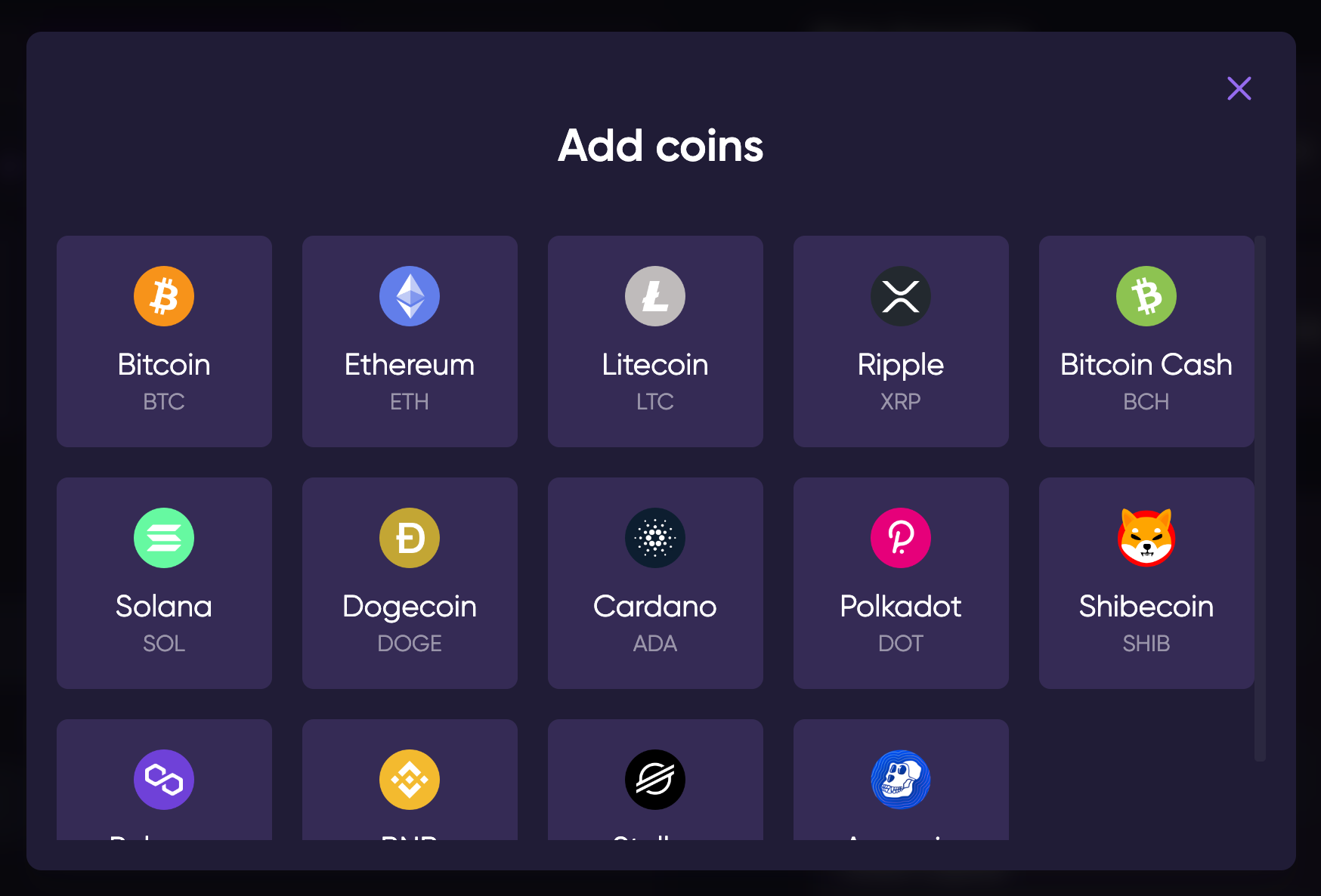

Build strategies with the top 10+ coins just in time for Summer of Crypto 2022

Tiny notes

- New icons in a few places

- Add coinin strategy builder

- Coin icons

- Fixed issues with automated strategy versioning

new

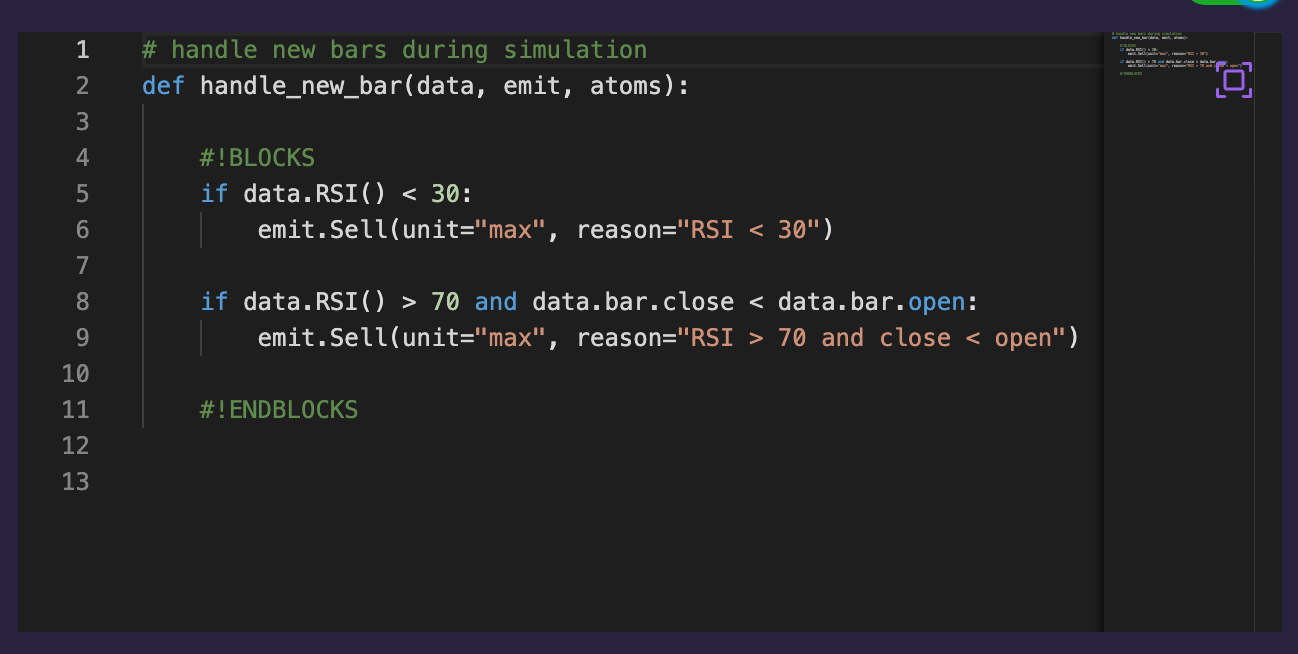

Code and QoL

A better code editor, theme overrides, and prettier achievements.

Monaco Code Editor

We've got a much better code experience, try it out in the strategy builder.

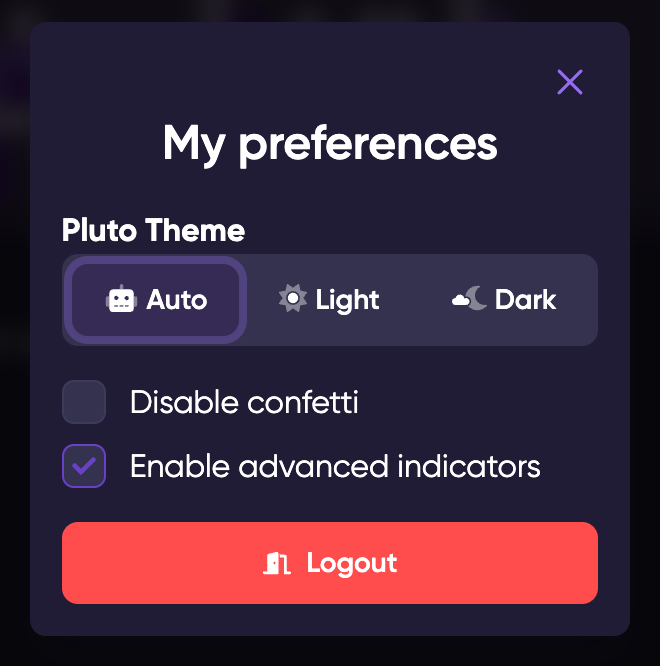

Theme Override

You can choose a theme now! Previously you got your system's preferred theme but now it's up to you.

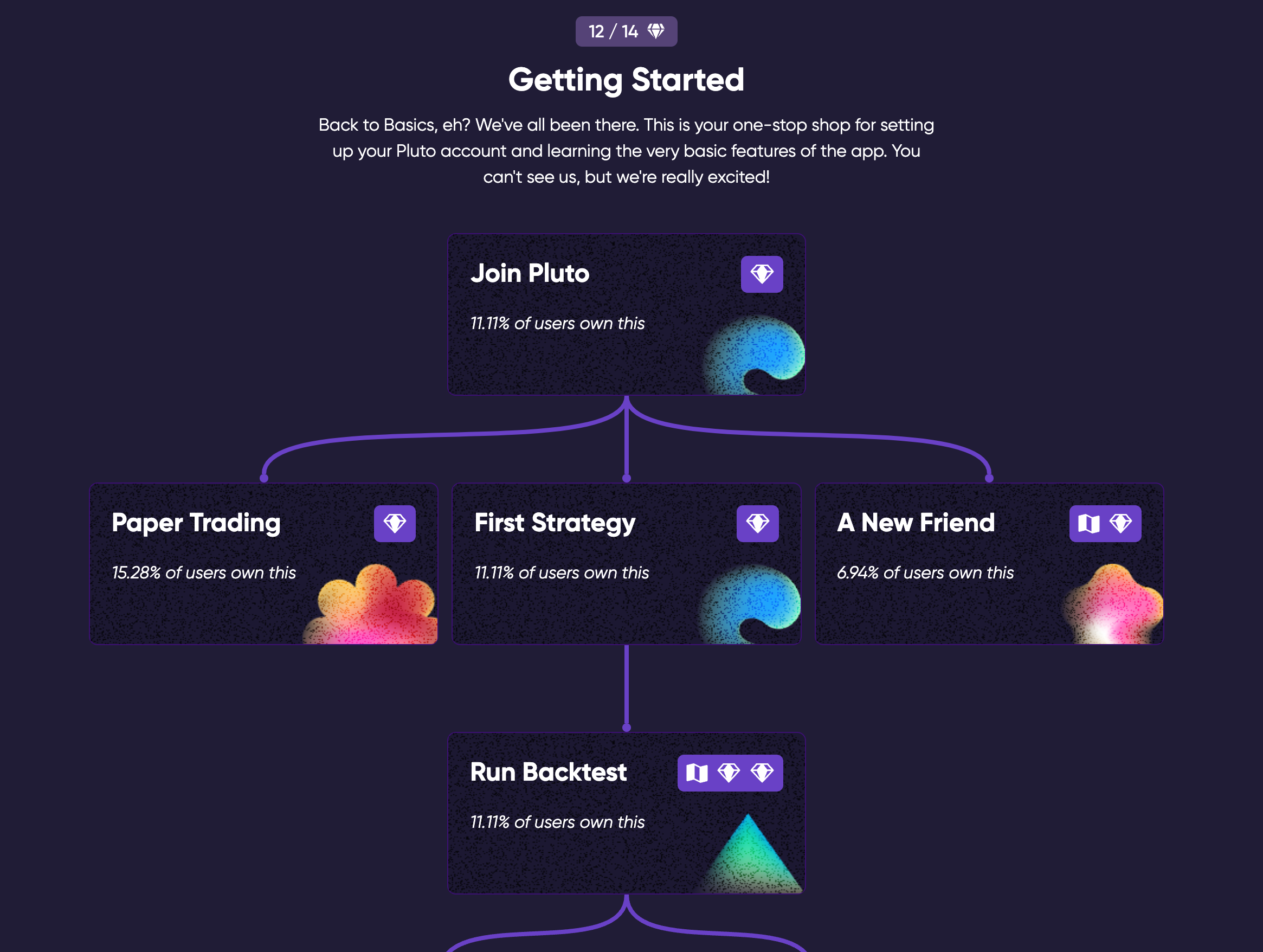

Achievements Coat of Paint

Wow, those really are gorgeous.

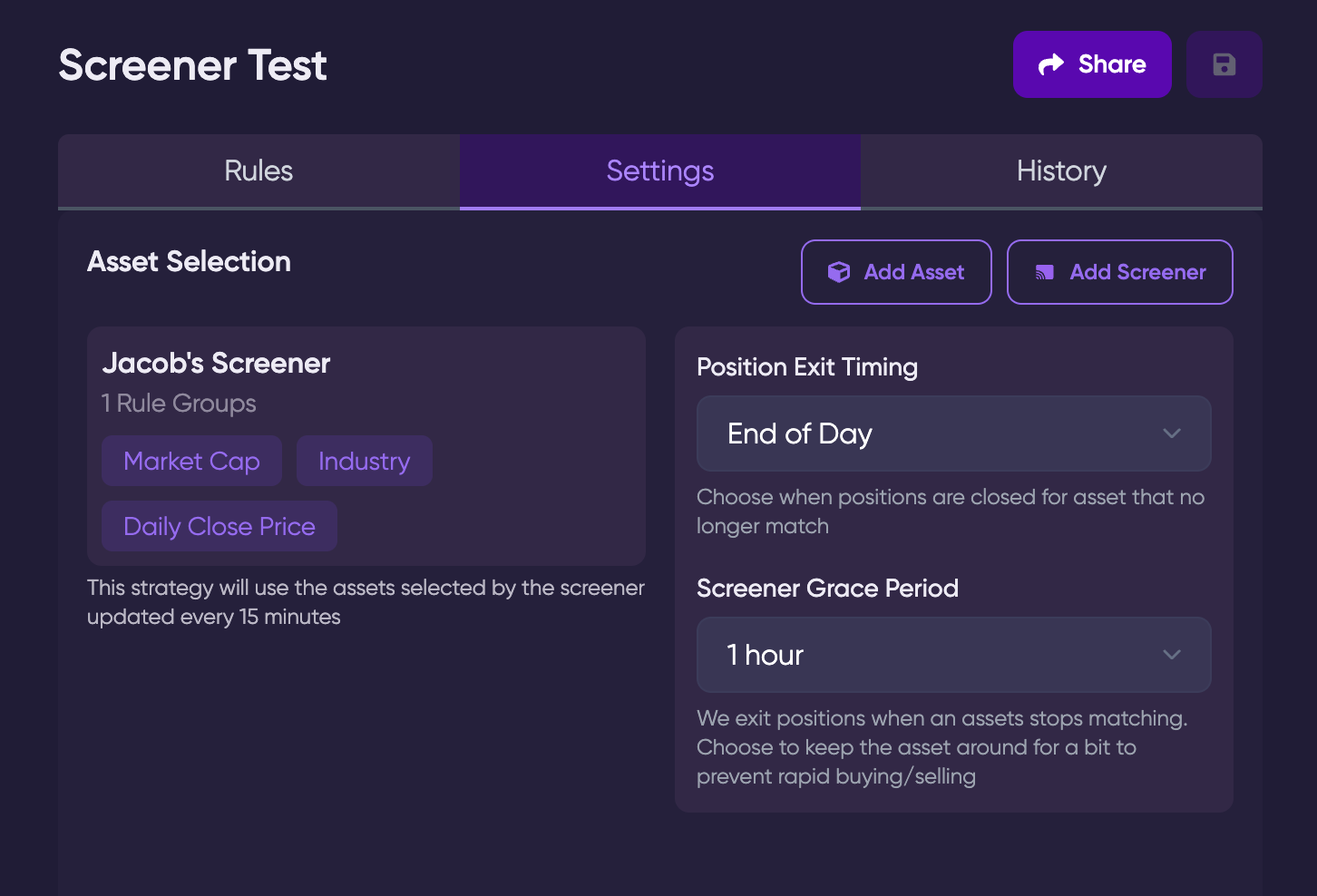

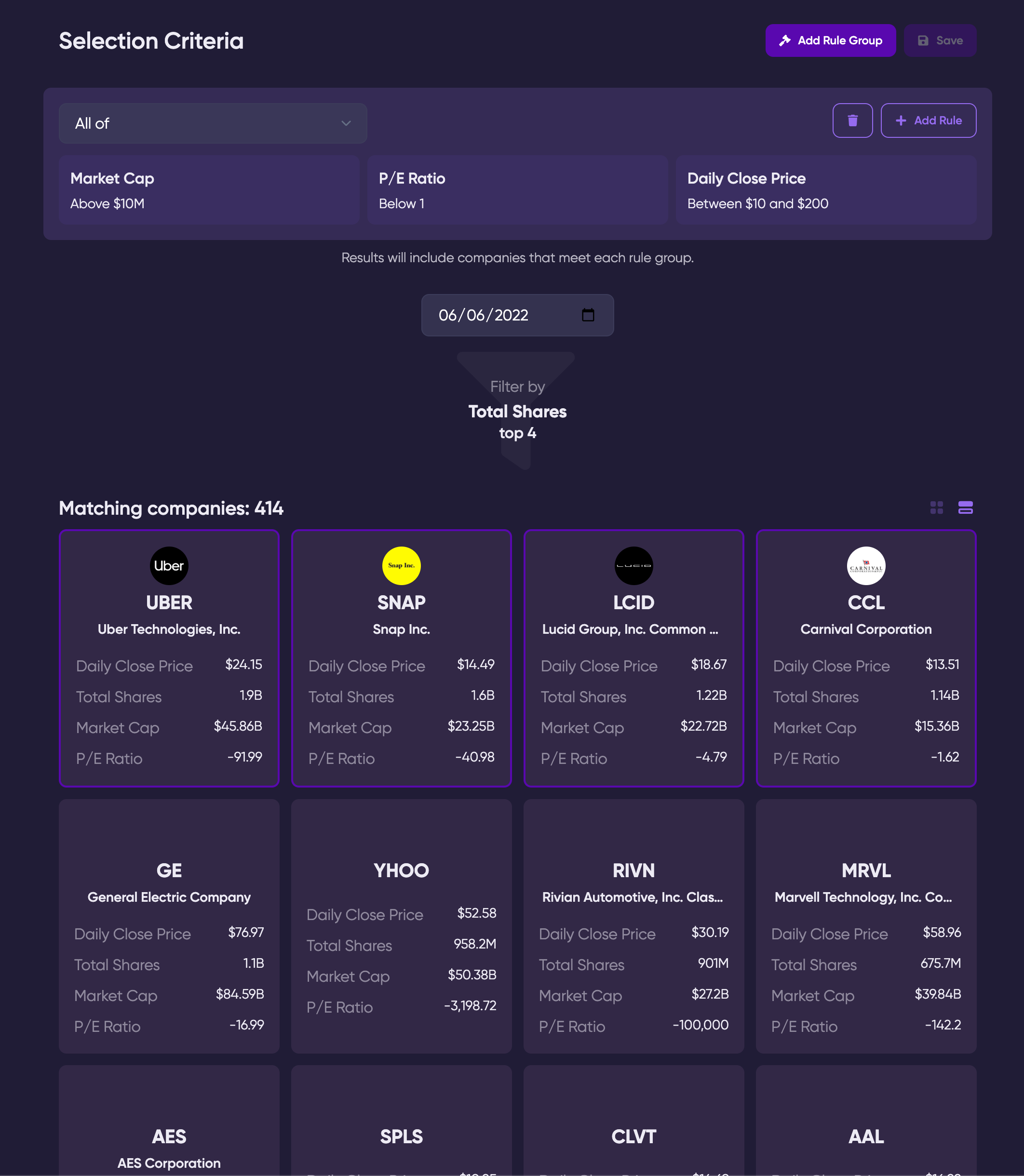

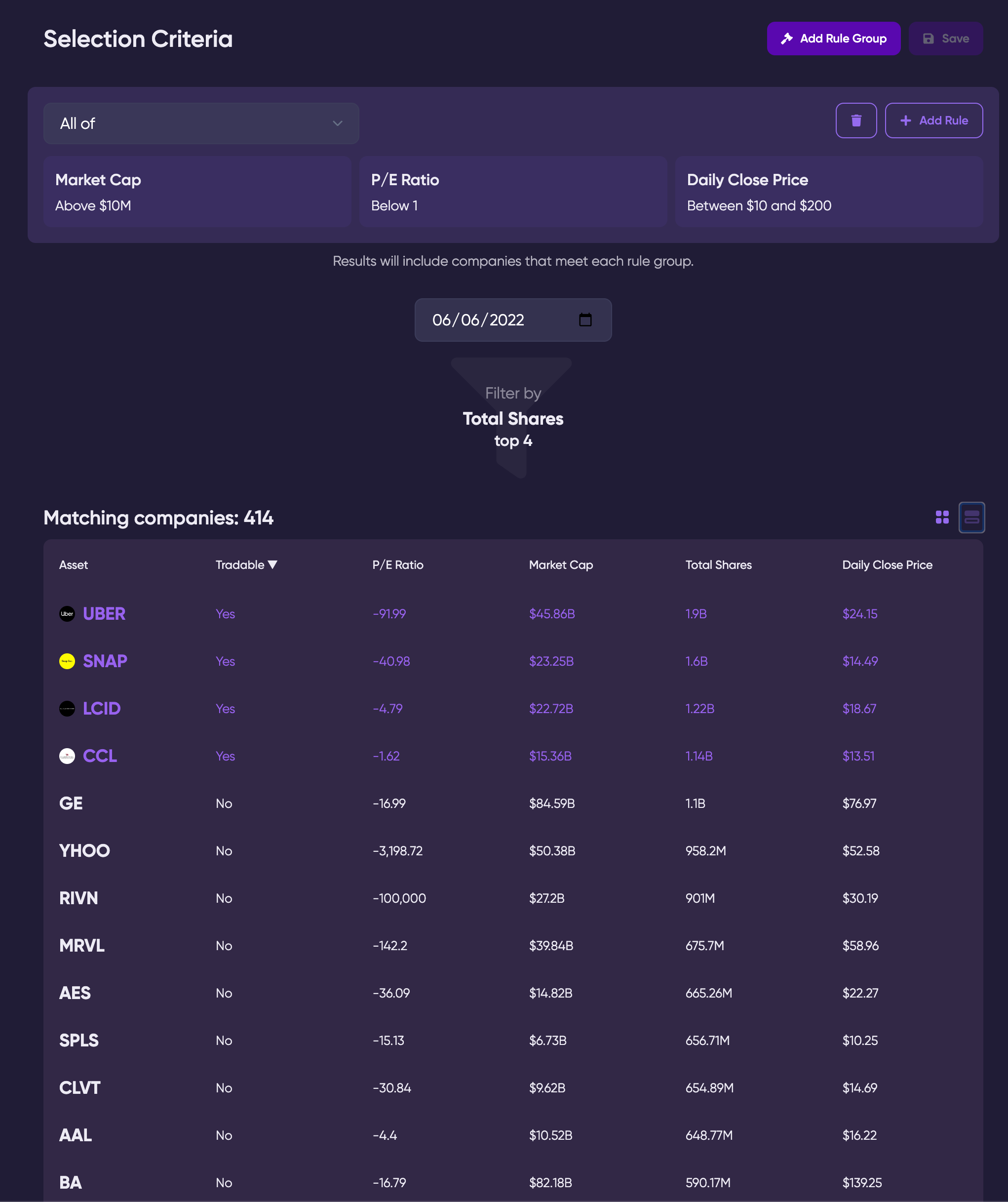

You can use screeners to pick the assets your strategies trade.

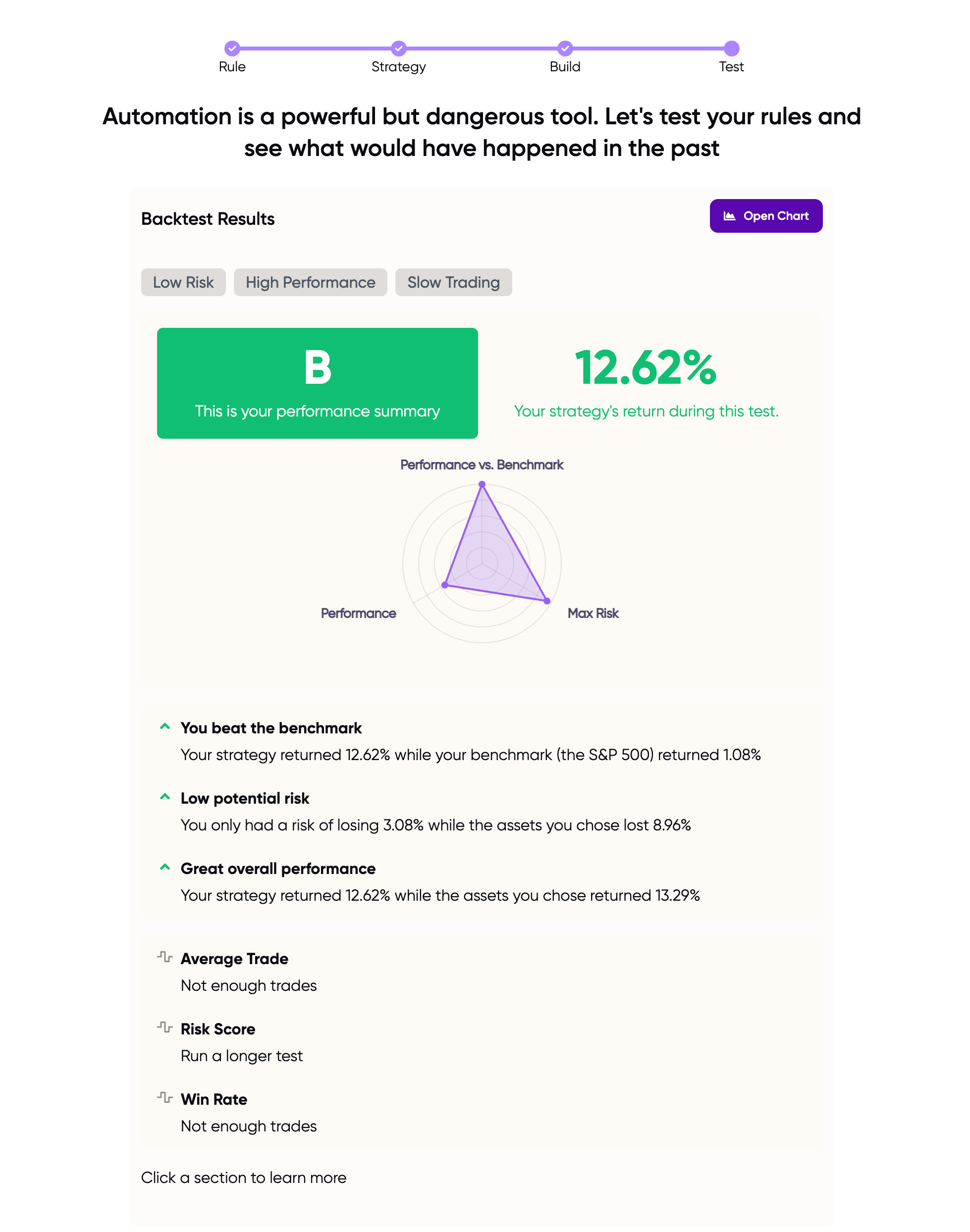

Screeners can be back-tested! We have ~10 years of historical data for screeners so you can see which assets would be selected for trading.

When you experiment with a screener — all results will be displayed and the tradable assets (the ones a strategy would buy/sell) are highlighted in

plurple

Some screeners return a ton of results so we added a new table view to make sorting easier.

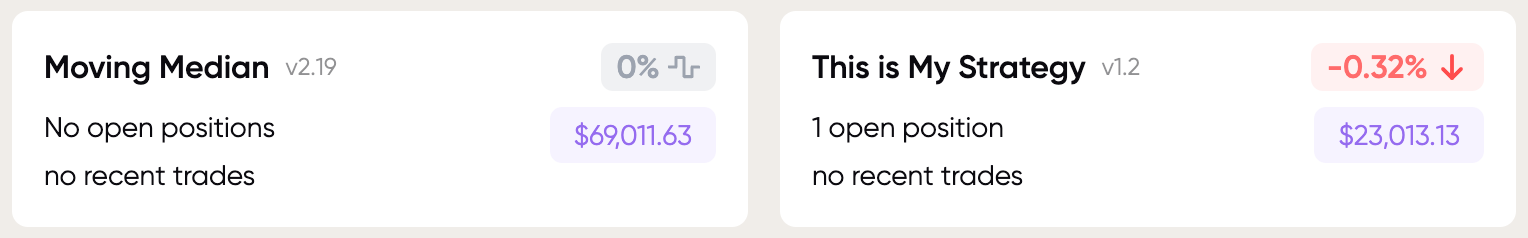

All strategies in your portfolio are pinned to a specific version — now you can see the version info right on the card.

New strategy building guide experience that'll keep you focused on learning.

New content from @parker coming later today.

Load More

→